Investing in change

“Sustainability did not used to play an important part of project due diligence,” says Tine Bremholm Kokfelt, Senior Project & Export Finance Manager at FLSmidth Cement. “The focus was on proving financial return, how a project would provide jobs and support local development, and some emissions – typically dust. Now, sustainability is at the centre of just about every project we work on. It’s a big change in terms of priorities.”

Pictured from left to right: Tine Bremholm Kokfelt, Senior Project & Export Finance Manager, Susanne Vedel Hjuler, Sustainability Manager, Sine Bøgh Skaarup, Head of Process Design, Lab & System Engineering

Tine works in FLSmidth’s Cement finance department, helping to connect our customers with the finance they need to move projects forward. The change she’s describing derives from a growing global consciousness of the dangers posed by global warming, and the ways in which climate change is being addressed through the financial markets.

While socially responsible finance has, to some extent, always been part of the financial scene, the increasing importance of ESG data to investors and lenders, starting with the release of the 2004 UN report ‘Who Cares Wins’ and more widely accepted with the Paris Agreement in 2015, has dramatically shifted the landscape. Now, within the cement industry at least, we have reached a point where nearly every investment is looked at through an ESG lens.

“What we don’t want to see is investors and lenders leaving the cement industry only to achieve their own short-term climate targets,” Tine says. “This doesn’t solve the problem – it just passes it on to other less suitable parties. Fortunately, there are a lot of funds out there actively seeking opportunities to finance projects that reduce carbon emissions – including those from the cement industry. The difficulty for these financiers is how to know which projects will actually perform. That’s where all the frameworks come in.”

Tine Bremholm Kokfelt, Senior Project & Export Finance Manager, FLSmidth Cement

How frameworks help prove the credibility of ESG investments

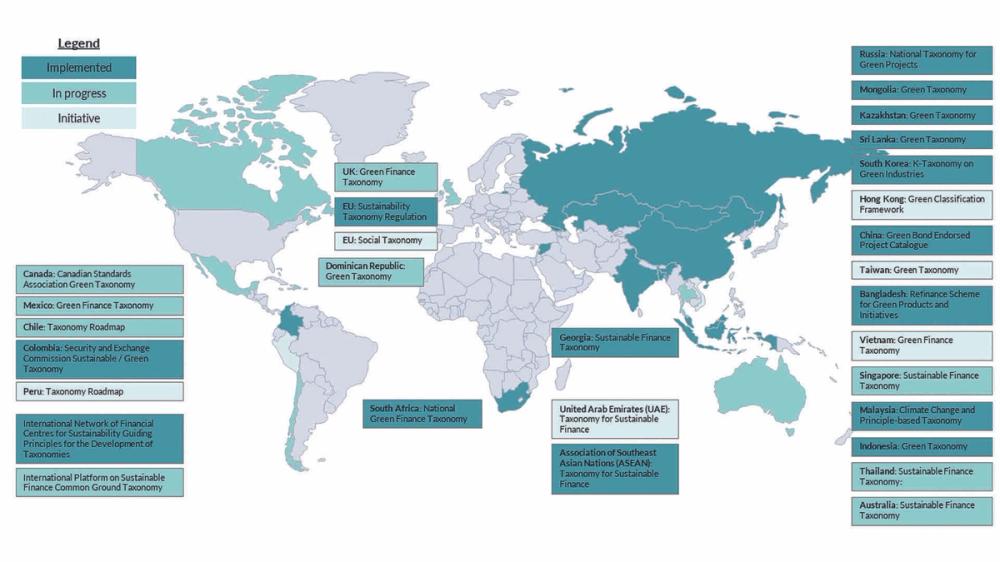

Frameworks such as the EU Taxonomy, a new European classification system, are designed to clarify which projects can be considered environmentally sustainable so as to protect financial stakeholders from greenwashing and help them finance projects that will contribute to protecting our planet. The EU taxonomy takes a ‘do no significant harm’ approach to sustainability, so aims not just for carbon reduction but also a safe working environment, community benefits, etc. The US is expected to develop a similar framework for investors, while many other countries have either started work on their own taxonomy or finalised one.

Figure 1 demonstrates just how many frameworks there are to navigate. While the structure of the taxonomies tends to be similar, the objectives, criteria and thresholds can differ. Some include transition activities; some use a traffic light system. If you consider that one project may seek financing from various multinational lenders, it’s evident that the frameworks – though certainly helpful – add an additional layer of complexity to funding bids.

Demonstrating environmental sustainability

“These frameworks are helpful from an investor and lender standpoint. However, they are often very high level, or include very specific comparisons – for example, how a product performs compared to the ‘next best solution’,” says Susanne Vedel Hjuler, Sustainability Manager at FLSmidth Cement. “We also need to be able to demonstrate environmental credentials of both our products and projects for specific customer cases, as well as impacts across our entire value chain. With the wide – and increasing – range of requests for documenting environmental sustainability performance, within different scopes and context we make use of different methods and tools. This includes Life Cycle Assessments (LCAs), as well as carbon footprinting. Some tools and methods are more granular than others, and provide the level of detail that the plant wants; others give relevant insights for investors.”

Our own in-house data demand has also increased with our commitment to achieve specific targets and contribute to worldwide efforts to keep global warming below 1.5˚C. According to our Science Based Targets (SBTs) pledge, by 2030 FLSmidth Cement will:

- Be carbon-neutral in our own operations by 2030

- Have 30% of our spend with suppliers with Science Based Targets, by 2025

- A 56% reduction in our economic intensity by 2030. (Meaning, if you consider the lifetime use phase of all products we sell in a given year, we need to reduce the ratio of the expected emissions associated with all of these products and their respective order intake. That ratio must reduce 56% by 2030.)

We made this commitment because we believe we have a responsibility to tackle climate change – and the opportunity to make a real difference. As part of our SBT reporting obligations, we collect information on every single energy consuming product that has been sold each year, including the required parameters to estimate the expected lifetime energy consumption. This data is then used to calculate lifetime greenhouse gas emissions from the product, applying greenhouse gas emission factors for all energy types, from external databases.

Assessment methods and tools – definitions and uses

A Life Cycle Assessment looks at all the potential environmental impacts of a project or product throughout its life – sometimes referred to as cradle to grave. For example, an LCA on a new clinker cooler project would consider the raw materials used to manufacture the cooler, as well as the construction and ‘use phase’ environmental impact, and ‘end of life’ – i.e. does it become waste, can it be recycled, etc. Even the manner in which the raw materials and finished machinery are shipped is considered. Further, it is also possible to conduct LCAs with a reduced scope, e.g. ‘cradle-to gate’, which includes all potential environmental impacts until the point where the product leaves the producer to be shipped to the customer. The relevant scope depends on the application of the study. LCAs are governed by ISO frameworks and require third party review. They can take hundreds of hours to complete, depending on the project/product being assessed.

LCAs can be used to produce Environmental Product Declarations (EPDs), which are specifically framed summaries of the LCA studies, excluding confidential information. LCAs are not usually publicly available, whereas an EPD can be a useful tool to show customers how your product performs in accordance with environmental targets. Cement manufacturers use EPDs, and the construction industry rewards the use of products with an EPD under certification schemes such as BREEAM, DGNB and LEED.

An LCA Light Study uses the same approach as an LCA, but may be based on more assumptions and less granular data and does not include a full ISO-compliant report and third-party review. Thus, an LCA Light Study can be produced more quickly. The resulting data is still useful for facilitating decision making.

Carbon footprinting addresses only greenhouse gas emissions, expressed as CO2-equivalents, rather than the full range of environmental impacts assessed in an LCA. These can still be made across the entire life cycle of a product, but may also focus on specific phases, such as the use phase.

Setting performance expectations with carbon calculators

“For decades, we’ve been issuing process guarantees on power, fuel and production, but in 2018 we started work on a specific tool to estimate CO2 emissions for every project,” says Sine Bøgh Skaarup, Head of Process Design, Lab & System Engineering. “We wanted to be able to estimate environmental impact – not only because we knew our customers were interested, but also because it helps us identify our ‘hot spots’, which is useful in our product development. This calculation requires additional data about external influences, such as the source of the power, the type of fuel, etc. It’s also the only calculation that considers the equipment within the system as a whole and how it all performs together, which gives us an idea of the opportunities for optimisation.”

The CO2 calculator is focused on the customer’s perspective – the cement making process. It addresses cement’s life cycle impacts from cradle to gate – including the operation at the cement plant, upstream impacts from raw materials, and transport.The calculator is built on the wealth of experience and knowledge of our Process Design Engineers about how our products will perform in a given application at customer’s cement plants, and further draws upon data from an LCA database, which adds greater depth to the calculation.

“Within our Process Design Department, every calculation we carry out is project-specific,” explains Sine. “For example, we’ll calculate the potential carbon reduction of clinker substitution or alternative fuel projects.”

While we usually provide operational guarantees such as power demand, fuel consumption and capacity, we don’t guarantee CO2 emissions because they are a result of power and fuel consumption and, of course, much depends on optimising operating parameters and the specific inputs at the plant. For example, we have no control if the electricity is generated from wind power or a coal fired power plant.

“Our ambition is for all proposals to include CO2 calculations,” says Sine. “The more experience we get, the more we can develop these tools, and the easier it becomes to perform the calculations. That’s not to say it’s simple – obviously, as the business case evolves, so does the calculation. But the tools are becoming more sophisticated. This not only helps steer the plant towards one solution or another, but also sets expectations for what the plant should be able to achieve with that project, in terms of carbon emissions.”

“From the lender’s perspective, we’re able to provide more and more detail to support their decision-making,” explains Tine. “And that’s become increasingly important as finance parties have to report on the CO2 coming from their investments.”

The CBI project

In 2022, we signed a contract with CBI Ltd in Ghana for a new calcined clay facility. The project will enable CBI to replace 30% of imported clinker and reduce CO2 emissions per tonne of cement by up to 20%. The project gained financing from the Danish IFU and Norwegian Norfund, both of which required the project to be EU Taxonomy compliant. Moreover, the Danish export credit agency, EKF extended a green loan financing. They all wanted to see the environmental impact of the project and how that would develop over time. This project required significant efforts from our team, who had to perform the necessary calculations.

The threat of greenwashing remains

Though these reporting and compliance frameworks are intended to protect investors from greenwashing; the threat remains.

“There’s no doubt that performing these calculations is incredibly important to help understand which is the right path to take, both from a process and ESG perspective,” says Sine. “But it’s also important to keep an eye on the long-term performance of the project. I hope that our customers keep those calculations in mind once their projects are up and running, as a benchmark for what should be achievable in their operation. And I hope that they will call us in to find further opportunities for optimisation. Sustainability is not a box-ticking exercise. It’s the performance that counts – that’s the data that really matters.”

.jpg?w=1080&q=80&auto=format)